san francisco gross receipts tax estimated payments

The Gross Receipts Tax applies to businesses with. Important filing deadlines include the San Francisco Gross Receipts filing deadline of February 28 and the April 1st business property tax filing.

Calendar Year vs.

. Final Payments for Q4 2014 The current due date for the City of San Francisco Payroll Expense Tax and Gross Receipts Tax statement is February 28. Beginning in 2023 estimated business tax payments are due April 30th July 31st and October 31st. Please note the following.

The City began making the transition to a Gross Receipts Tax from a Payroll Tax based on wages paid to employees in 2014. San Francisco has imposed both a payroll tax and a gross receipts tax since 2014 on persons engaging in business within the City. Greater than 3001 a 03.

Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. In 2022 San Francisco has many unique corporate tax deadlines beyond the traditional April 15th tax return date. On September 9 2020.

For example an entity with an executive pay ratio of greater than 2001 would pay a 02 overpaid executive tax rate. A fiscal tax year is 12 consecutive months ending on the last day of any month except December. The calendar tax year is 12 consecutive months beginning January 1 and ending December 31.

The applicable gross receipts tax rate depends on the business activity associated with the gross receipts earned. The quarterly estimated payment shown in our system is based on your 2021 Annual Business Tax Returns filing. For the Gross Receipts Tax GR we calculate 25 of your Gross Receipts Tax liability for 2021.

25m Retail Trade. Lean more on how to submit these installments online to comply with the Citys business and tax regulation. The San Francisco Gross Receipts Homelessness Gross Receipts Commercial Rents andor Payroll Expense tax.

6 The passage of Proposition F fully repeals the Citys Payroll Expense Tax. Annual business registration fees. Under the general rule the registration fee is 90 for businesses with less than 100000 in receipts which increases to 35000 for businesses with more than.

An EDD representative may call employers. The fiscal year for the City and County of San Francisco starts on July 1 and ends on June 30. The tax rate reaches its maximum level when the ratio reaches 600 to 1 with a maximum tax on payroll of 24 percent or a surcharge on.

Estimated tax payments due dates include April 30th August 2nd and November 1st. Manufacturing transportation and warehousing information biotechnology clean technology and food services Code Sec 9532 Accommodations utilities arts entertainment and recreation Code Sec 9533. Welcome to the San Francisco Office of the Treasurer Tax Collectors Business Tax and Fee Payment Portal.

The required quarterly estimated payments are each 25 of the prior year or current year tax liabilities whichever is less. Persons other than lessors of residential real estate must file applicable Annual Business Tax Returns if they were engaged in business in San Francisco in 2021 as defined in Code section 62-12 qualified by Code sections 9523 f and g and are not otherwise exempt under Code sections 954 2105 and 2805 unless their combined taxable gross receipts in the City. You may pay online through this portal or you may print a stub and mail it with your payment.

In addition to transitioning from a Payroll Expense Tax to a Gross Receipts Tax Prop E also shifts the Citys Business Registration. Calculations of 2022 estimated quarterly business tax payments will be based on the information entered in your San Francisco Annual Business Tax Return for 2021 and will be displayed in the payment portal within 24 hours of completing your filing. San francisco gross receipts tax estimated payments Friday February 18 2022 Edit.

Ad Pay Your Taxes Bill Online with doxo. San francisco gross receipts tax estimated payments Friday February 18 2022 Edit. You are only required to make estimated tax payments if your taxable payroll is greater than 260000 or your gross receipts are greater than 1000000.

For tax year 2017 the gross receipts tax rates range from 005625 to 04875. San Francisco Gross Receipts Tax Anatomy Of San Francisco Now Fewer People Jobs Tourists Businesses But More Spending By The Hangers On But That Was Inflation Wolf Street. In 2014 the Office of the Treasurer and Tax Collector began implementing the Gross Receipts Tax and Business Registration Fees Ordinance.

If the executive pay ratio exceeds 1001 then an additional tax will be imposed on apportioned San Francisco gross receipts ranging from 01 to 06 depending on the computed executive pay ratio. In an effort to eliminate this perceived tax disincentive in November 2012 San Francisco voters passed Proposition E Prop E enacting the Gross Receipts Tax which went into effect on January 1 2014. Under the ordinance the City will phase in a Gross Receipts Tax and reduce the Payroll Expense Tax over the next five years.

HRGT imposed additional business taxes to create a dedicated fund to support services for homeless people and prevent homelessness including one tax of 0175 to 069 on gross receipts over 50 million that a business receives in San Francisco and another tax of 15 on certain administrative offices payroll expense in San Francisco. Residential Landlords with 2000000 or less adjusted for inflation in San Francisco gross receipts are exempt from estimated quarterly business tax payments and will not receive an estimated business tax payment notice. Estimated business tax payments are due April 30th July 31st and.

Use your San Francisco Business Activity and the SF Gross Receipts Tax Computation Worksheet to determine your San Francisco Gross Receipts Tax obligation. 5 The current Payroll Expense Tax was originally set to phase out ratably between 2014 and 2018 but was postponed by the City in 2018. Over the next few years the City will phase in the Gross Receipts Tax and reduce the Payroll Expense Tax.

Like Proposition F Proposition L will require a 50 1 affirmative vote for approval and would be. The Business Tax and Fee Payment Portal provides a summary of unpaid tax license and fee obligations. San Francisco Tax Collector PO.

Business Tax Overhaul. San Francisco businesses are also subject to annual registration fees based on San Francisco gross receipts for the immediately preceding tax year. You may pay the lesser of the amount displayed or an amount equal to 25 of your Business Taxes due for 2022 which may be 0.

Which was approved by voters in November 2012 Proposition E. On Comparison of Top Executives Pay to Employees Pay more commonly known as the CEO tax or the Overpaid Executive Pay Ratio Tax will appear on the ballot as Proposition L. Quarterly estimated tax payments of weird Gross Receipts Tax Payroll.

Businesses operating in San Francisco pay business taxes primarily based on gross receipts. San Francisco gross-receipts tax updates. Mail your business tax and registration fee payments to.

California Estimated Taxes In 2022 What You Need To Know

Fedex Drivers Salary Comparably

I Make 120k Year In Bay Area But My Monthly Net Is 5700 What S Wrong Quora

California Estimated Taxes In 2022 What You Need To Know

3 8 45 Manual Deposit Process Internal Revenue Service

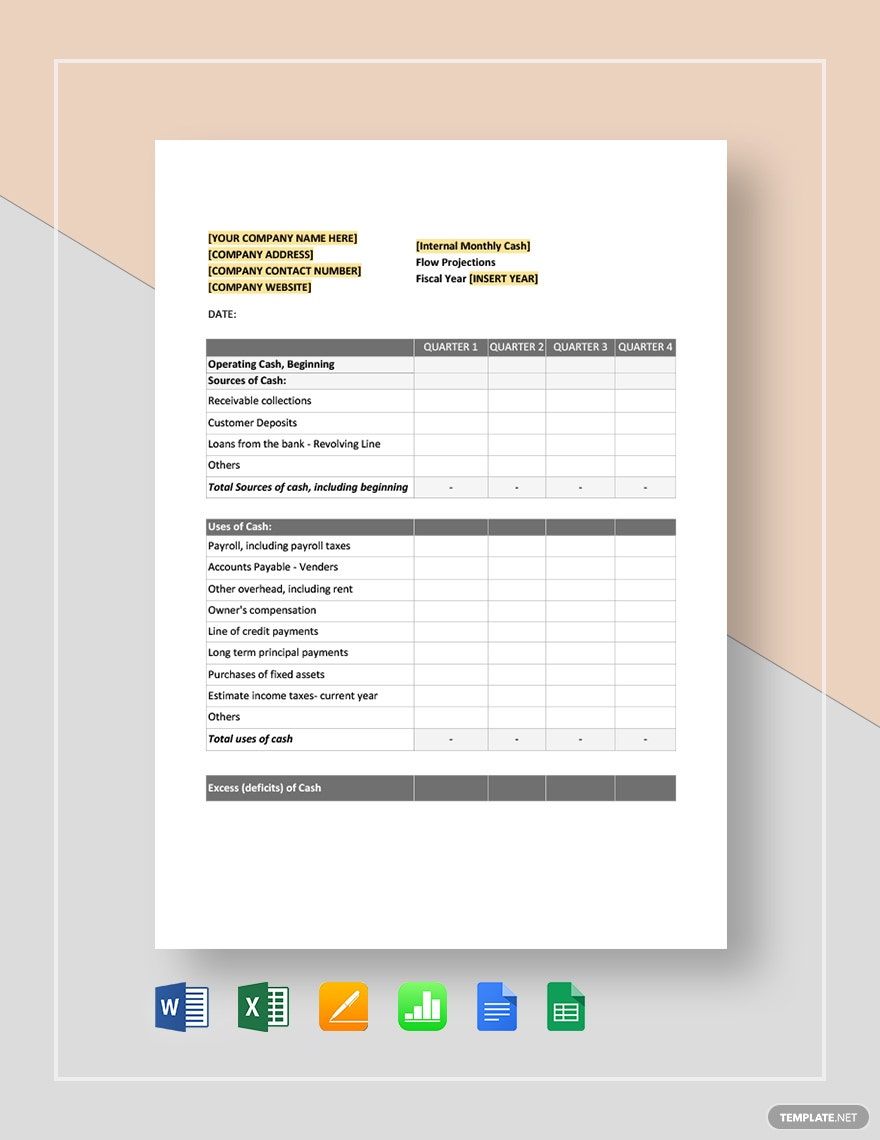

Construction Finance Templates 97 Designs Free Downloads Template Net

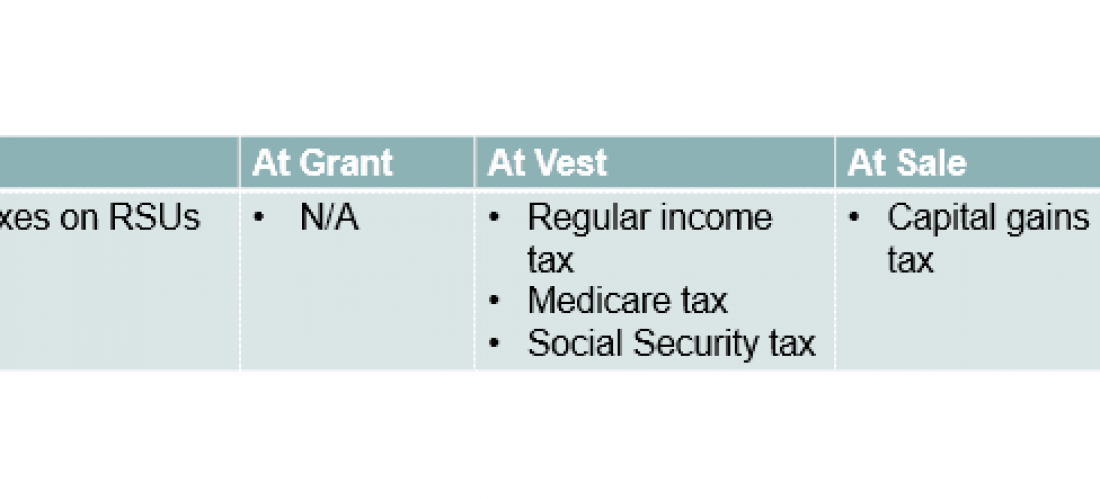

Equity Compensation 101 Rsus Restricted Stock Units

How To Self Clear Customs For Ups Shipment Commercial Invoice Invoice Template Invoice Template Word Invoice Layout

3 11 3 Individual Income Tax Returns Internal Revenue Service

How To Create A Customer Service Plan Edward Lowe Foundation How To Plan Small Business Start Up Accounting Services

How To Create A Customer Service Plan Edward Lowe Foundation How To Plan Small Business Start Up Accounting Services

California Self Employment Tax Calculator 2020 2021

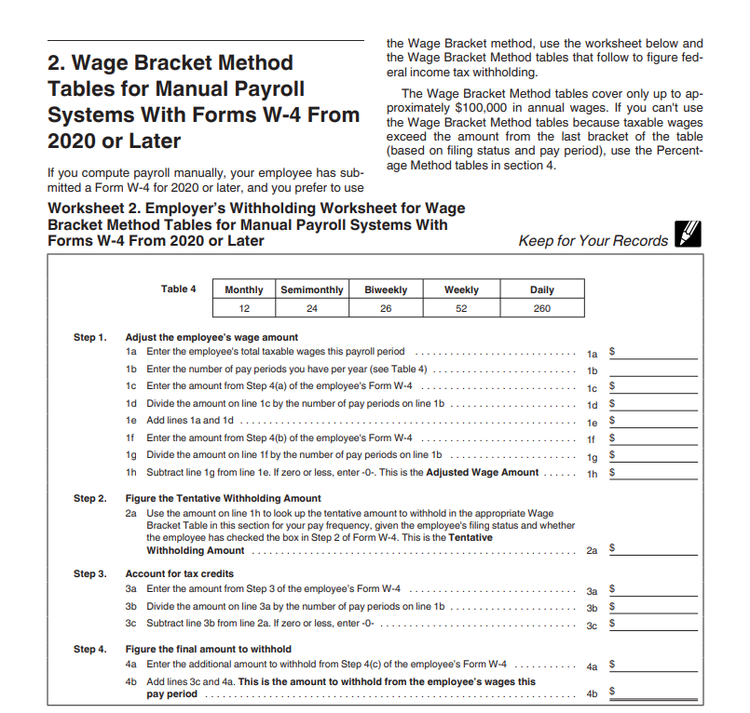

How To Calculate Payroll Taxes For Your Small Business

Tax Senior Analyst Resume Samples Velvet Jobs

3 8 45 Manual Deposit Process Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service